When you have insurance on your car, the insurance pays to repair or replace the car if it’s damaged by specified disasters such as fire, accidents, etc. The same applies to the Homeowners Insurance, it pays for damages to homes by disasters such as Fire, Heavy Rains, theft, lightning, and the likes.

If you don’t have adequate information with regards to the homeowner’s insurance coverage and its policies, you might pay more for less coverage.

Below are the six best insurance companies of 2021 if you need more clarification on homeowners insurance.

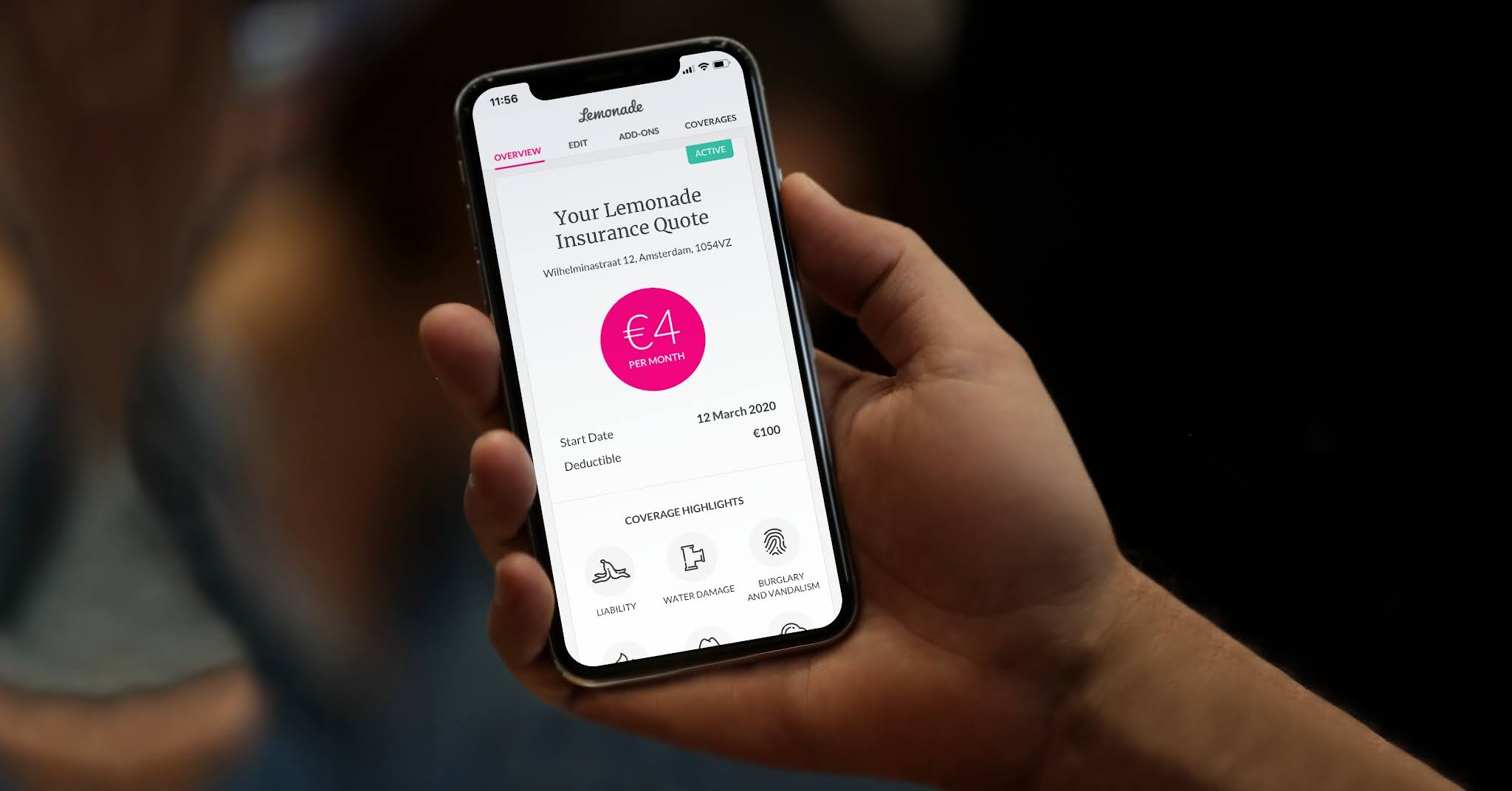

1. Lemonade Insurance:

This is a solely online insurance company. It uses artificial intelligence to provide fast insurance quotes and claims payments. You just have to fill out a form on their website and select the coverage amount you want. You get your quotes within a few minutes.

The claims process and the reimbursement of funds are paid within a few minutes because of the use of AI. The company has a special approach to paying for its operations and the use of its profits.

They are funded through a flat fee that’s added to the policy’s premium. They have something they call the Lemonade Giveback program, where 40% of the premiums that are not used to pay out claims will be given to a non-profit organization of your choice when you initially sign up.

Some of Lemonade’s standard selection of coverage options include:

- Loss of use coverage

- Medical payments

- Personal property coverage

- Personal liability coverage

- Dwelling coverage

- Other structures coverage

Merits of Lemonade Insurance

- They have a Demotech Financial Stability Rating of A

- They have unusually fast claims and quote payments

- They have a flat fee rate for administration together with low monthly premiums.

- Claims money that isn’t used is paid to a non-profit of your choosing.

De-Merits of Lemonade Insurance

- It’s not available in all the 50 states of America.

2. Erie Insurance:

This is the only insurance company among many that include a Guaranteed Replacement Cost coverage as part of their standard coverage. This coverage enables homeowners to rebuild their homes exactly the way it was before the incident, rather than being given an amount based on the home’s age.

The policy includes a renovation of the roof as well, although a full replacement would cost extra. They offer a 16% to 25% discount for bundling and additional discounts if you want to install automatic sprinklers, burglar alarms, and smoke detectors.

Their policy also covers these other items which come at an extra cost with other companies:

- Cash and precious metals

- Gift card and gift certificates

- Valuables and hard to replace items

- Animals, birds, and fish

The following coverage can also be added to an Erie policy:

- Service line protection

- Identity recovery services

- Water backup and sump overflow

- Personal liability coverage.

Merits of Erie Insurance:

- They have discounts available when bundling with auto insurance

- Some of their add-ons include liability coverage, identity recovery, and service line protection

- They have been ranked A+ according to the A.M Best Ratings.

- They have customizable coverage deductibles

- They ranked 6th out of 20 according to the J.D. Power Ranking.

De- Merits of Erie Insurance

- They are only available in 12 states in America.

3. Allstate Insurance:

With Allstate Insurance, homeowners who take very good care of their property are compensated. You can also get up to a 20% discount if you switched to Allstate without filing a claim with your previous insurer.

They also reduce your deductible amount every other year you stay with them without making a claim. They offer a Rateguard option which gives you the opportunity to file one free claim after every five years without an increase in your premium. This comes with an extra fee.

They also offer optional coverage for:

- Sports equipment

- Electronic data recovery

- Business property

- Musical Instruments

- Yard and Garden

- Water backup

- Identity theft restoration

- Green improvement reimbursement

Advantages of using Allstate Insurance:

- The rate guard option locks in your premium

- There is an additional rebate when renewing your standard policy.

- There is HostAdvantage for home-sharing or renting

- They are ranked 7th out of 20 according to J.D. Power Rankings.

- They are rated A+ on A.M. Best Rating.

Disadvantages of using Allstate Insurance

- The HostAdvantage feature isn’t available in all the states of America.

4. Amica Mutual Insurance:

Amica tops customer service on claims, having topped the J.D. Power ranking for nine consecutive years. One other thing that makes them stand out is their Contractor Connection Database, which guarantees the work of thousands of licensed, insured, and vetted contractors with a five-year warranty.

Amica also offers loyalty to customers who have been with them for two years at least. To those who are and are claim-free for at least three years, they offer breaks to them.

For customers who require additional coverage, they offer:

- Home business coverage

- Valuable items coverage

- Catastrophic coverage

- Identity fraud expense coverage.

Advantages of Using Amica Mutual Insurance:

- They are rated number 1 out of 20 according to the J.D. Power Rankings.

- Rated A+ on A.M Best Rating

- You are connected to the contractors through a contractor connection database.

Disadvantages of Using Amica Mutual Insurance:

- The discounts are not available in all states

- The contractor connection is not available in HI and AK.

5. USAA Insurance:

This is a highly rated insurance provider for military personnel and their families. This includes children of veterans and those who are still serving. USAA also has a standard Guaranteed Replacement Cost coverage which gives homeowners the opportunity to rebuild their homes exactly the way it was before the incident.

The company is also known for having very low premiums.

Advantages of Using USAA Insurance:

- They have an A.M. Best Rating of A++

- They have a home-sharing coverage.

- You get 10% off with a car insurance

- There are discounts for condos or renters’ insurance policyholders with no claims.

Disadvantages of Using USAA Insurance:

- Home sharing is not available in every state

- It is only available for military personnel and their families.

6. Hippo Insurance:

This is an online insurance company that allows you to get the quote in a minute and receive your policy in five minutes. Hippo provides a smart home discount when you agree to install and use a free smart home monitoring system.

They also offer a HomeCare Expert program that ensures that policyholders who require maintenance are given professional service recommendations via phone. The discounts the company offers are subject to the use of a smart home kit, given at no cost.

Hippo Insurance also offers to cover:

- Smart home upgrades

- House cleaners and sitters

- Water backup

- Service line protection

- Enhanced rebuilding

- Costs for local ordinance changes

- Full replacements costs

- Appliances and electronics

- Computers and home office equipment

Pros of Hippo Insurance:

They offer home-care services

They get discounts when using Hippo’s Smart Home System

You obtain an online quote in 60 seconds

You can purchase a policy online in around 5 minutes.

Cons of Hippo Insurance:

- They have limited coverage in America

- They have discounts available for homes with access to digital and smart systems.

7. AIG Insurance:

AIG is an insurance company for most luxurious homes. It provides expensive homes with comprehensive coverage, from their dwelling to cybersecurity protection.

It also offers guaranteed replacement costs for homes that are valued from $750,000 to $100million on an all-risk basis.

This means that your policy covers all perils except the ones specifically excluded.

You must have another policy with the company to get the homeowners insurance with the AIG. They have services that can help prevent accidents and take care of them.

AIG also offers services such as:

- Business property coverage

- Crisis management and reputation restoration

- Landscaping coverage

- Kidnap, ransom, and extortion coverage

- Multinational property coverage.

Pros of using AIG Insurance:

- They have robust cybersecurity coverage.

- They have coverage for properties outside the United States

- They have a lower average premium than other high-end competitors

- They have coverage for homes worth up to $100 million.

Cons of using AIG Insurance:

- Customers would have to buy more than one policy with the company

- They have low customer service ratings

Other Home Insurance Companies You Can Consider:

- State Farm Insurance

- Farmers Insurance

- Liberty Mutual

- Travelers Group

- Chubb Insurance

- American Family etc.

We hope this article informs your decisions on the best homeowner insurance to buy. Thank You!!! You can check out the best car insurance companies in the US in 2021.

GIPHY App Key not set. Please check settings